Platform Overview

Comparison to MEV Boost

Recall that we divide a block in two parts:

- also referred to as

alpha- represents the top part of the blockspace. Economically, this is where competitive searchers want to place their transactions (e.g. for arbitrages etc.) The other part, called - also referred to as

beta- represents the rest of the blockspace. Economically, this is where low-priority transactions - direct transfers, low volume swaps, some kind of intents, etc. - would go. The rationale for this is simple:alphaand below represent two very different markets: The first serves strategic actors, whereas the second serves 'everyone else' - people not interested in speculation that just want to transact, e.g., to pay for stuff.

alpha is a very time sensitive kind of blockspace, as mev-rich txs often come in last minute. This

is the crucial MEV Boost Auction in which we also must maintain full backwards compatibility with.

Extending MEV Boost out-of-protocol

The idea is this: Since we run our own validators, we will know 2 epochs in advance in which slots we will mint a block. So, we can sell that blockspace about 2 epochs in advance, providing a futures market for below. The following diagram shows an example of how this would work. Crucially, we want users to be able to transact, that is, to be able to resell the futures on a secondary market.

Current MEV Boost Auction

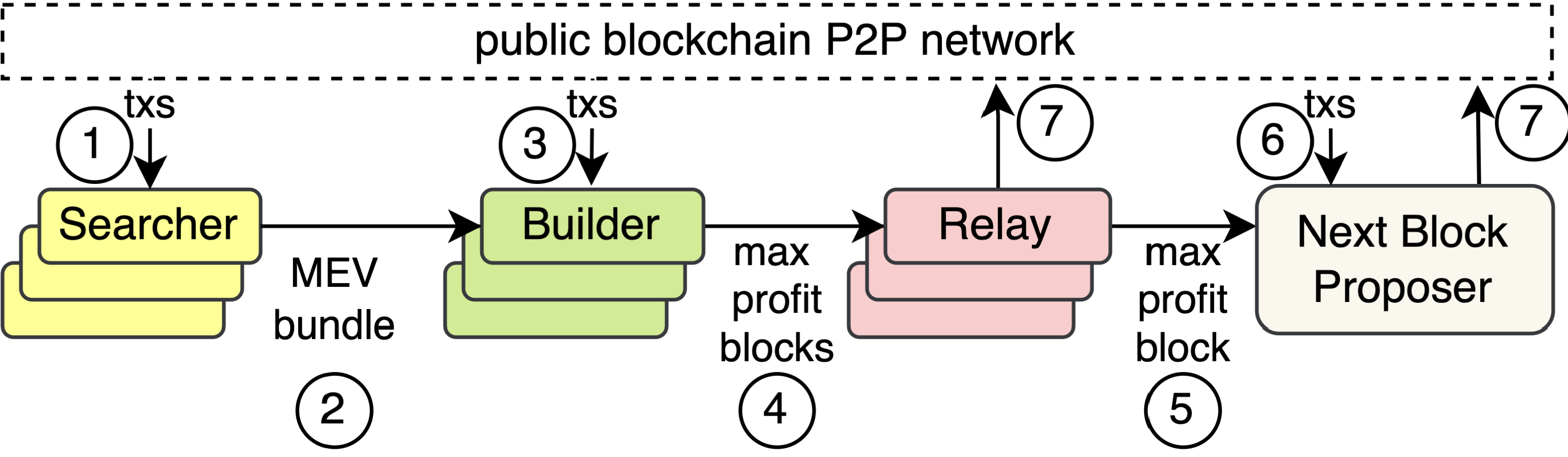

A representation of transaction and block propagation with Proposer Builder Separation.

(1) Searchers receive transactions from the P2P layer and generate transaction bundles using their specific MEV extraction knowledge. (2) These bundles are then sent to one or more builders. (3) Builders, who also receive transactions from the P2P layer, bundle blocks considering the transactions and bundles from searchers, guided by their local profit maximization algorithm. (4) Builders connect with relays and send new maximum profit blocks to these relays as they’re discovered. (5) Upon request, relays share the status of the maximum profit bid with the next block proposer. (6) The block proposer, who receives transactions from the P2P layer as well, decides which block to mine based on the relay information and their own interests. (7) If the block proposer chooses the block from the relay, they return the signed block header, prompting the relay to share the actual block